Quoting this excellent commentary:

“[T]here is something both startling and disturbing about the gloom that has settled over Wall Street and the country in general. In fact, looking back over the past century, it would be a stretch to rank the current problems as especially notable or dramatic. Something else is going on – namely a cultural rut of pessimism that is draining our collective energy, blinding us to possibilities, and eroding our position in the world.”

There are extremely relevant, objective and quantitative perspectives offered in that commentary which makes it well worth the short read.

Here are some additional perspectives:

1) In the prelude to the 2001 recession, the NASDAQ lost almost 70% of its value in less than 13 months.

And yet, as I documented here, the 2001 recession was the second shortest recession since World War II and arguably the least severe recession since World War II.

When somebody can document that, nationwide, the median home value declined by almost 70%, I will begin to think that we might be in for a really mild recession. Until then, it’s all just a bunch of hysteria pimping from so-called “journalists”.

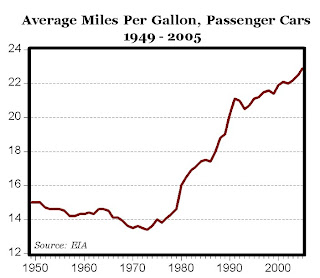

2) With a giant hat tip to an excellent blog (Carpe Diem), click each of the images below to read the associated blog post:

Click the image to read the associated blog post

Click the image to read the associated blog post

And, there’s a great deal more fine perspective on the current state of our economy at Carpe Diem.

No comments:

Post a Comment