The BEA Advance Estimate is that GDP grew at

Update: Q3 GDP has been revised downward to 2.2%.

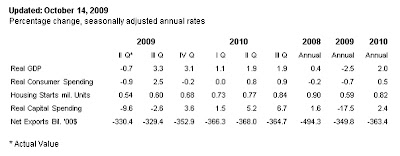

Below is the 10/14/09 GDP forecast from The Conference Board.

Click the image to enlarge it:

Click here for the latest forecast.

In this post, I want to examine and comment upon the 3rd quarter results, the so-called Federal “stimulus” and how that “stimulus” relates to the question of whether the recovery -- if we have one -- is real or illusory.

1) Many assert that 3rd quarter GDP growth was largely a function of government “stimulus” spending -- especially on the infamous “Cash for Clunkers” program. There is some truth in that.

The BEA report indicates:

“Motor vehicle output added 1.66 percentage points to the third-quarter change in real GDP…Table 2 of the BEA report notes that 0.62% of the growth resulted from Federal spending.

The third-quarter increase largely reflected motor vehicle purchases under the Consumer Assistance to Recycle and Save Act of 2009 (popularly called, ‘Cash for Clunkers’ Program).”

So, in those two line items alone, it is arguable that Federal “stimulus” could have accounted for 2.28% of the 3.5% GDP growth. But, there WAS also growth in other areas.

2) Additionally, The Conference Board predicts continuing (sluggish) GDP growth for the next 4 quarters.

But -- as of 11/2/09 -- (more than 1/3rd of the way through the 4th quarter) less than 16% of the allocated $793 billion in so-called “stimulus” spending had actually been spent. Therefore, much of that forecasted “growth” could well be phony “growth” from continuing Federal boondoggle spending (of money which we DO NOT HAVE ON HAND).

Click here for the most current -- and more comprehensive -- “stimulus” spending data.

Note: What is listed as “tax cuts” in the two prior links is, per USA Today, actually a “credit” given to people “who do not earn enough money to owe income taxes”. This is NOT a tax cut, it’s just more spending -- in the Marxist tradition of “spreading the wealth around”!

Phony or not, IF GDP “growth” continues, then the NBER will probably eventually conclude that we emerged from recession in Q3 of 2008.

3) The next question is -- what was the net impact of the so-called “stimulus” package?

By Obama’s own estimates, the so-called “stimulus” (predictably) INCREASED unemployment. And, pretty much everybody expects the unemployment rate to get even worse before it gets better -- IF it gets better.

But, I really do NOT believe the Dims ever expected the so-called “stimulus” to blunt the severity or duration of the recession. The so-called “stimulus” was NOTHING but a pay back to all the special interest groups who swept the Dims into a supermajority power position they had not enjoyed since the disastrous days of Jimmy Carter.

No comments:

Post a Comment