Please register your opinion with your representatives.

Please ask your friends & neighbors to do the same.

It is QUICK and EASY! See the bottom of this post.

Quoting Treasury Secretary Paulson in his statement

before the Senate Banking Committee on 9/23/08

(Emphasis Mine):“ We must now take further, decisive action to fundamentally and comprehensively address the root cause of this turmoil.

And that root cause is the housing correction which has resulted in illiquid mortgage-related assets that are choking off the flow of credit which is so vitally important to our economy.”

Click the image & read the rest:

If “the housing correction” is the best excuse Paulson can muster for a $700 billion bailout, I say NO WAY!

If “the housing correction” is the best excuse Paulson can muster for a $700 billion bailout, I say NO WAY!1) Last July, I commented on

Media Housing Hysteria vs. Their Own Source.

2) The following represents the latest data for Median Sales Price of Existing Homes:

Click the image to enlarge:

I personally created and uploaded the above chart.

The data used in the above chart are found in

this spreadsheet downloaded from this page.Contrary to media hysteria, the data clearly demonstrate that this “housing correction” is already bouncing back WITHOUT any $700 billion bailout!2A) 10/5/08 - Update to the original post of 9/24/08:

The latest data indicate home prices declined again in July and August. However, February still represents a bottom. New data will be released around 10/25/08.

Click the image to enlarge:

I personally created and uploaded the above chart.

The data used in the above chart are found in

this spreadsheet downloaded from this page.3) Furthermore, there are

very few states where there existed any

“housing correction” at all!

The condition of the housing market in each individual state can be graphically verified in the previous link. Why should the entire nation pay for the follies of a very few states?

As an example, here is California in blue and Florida in red mapped against Colorado in green:

Click the image to enlarge & view the source:

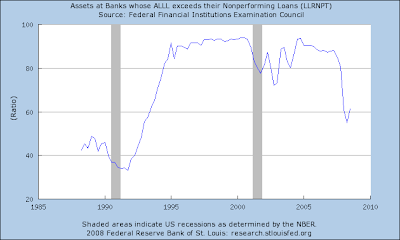

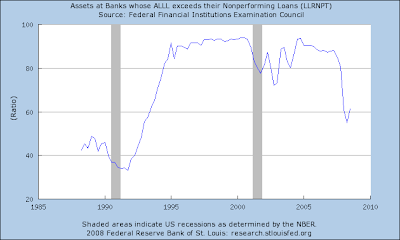

4) Data from the St. Louis Federal Reserve on the condition of the nation’s banks does not seem to justify a $700 billion bailout:

Click the image to enlarge & view the source:

5) Although some large financial institutions have failed this year, the following data present further evidence suggesting that the overall banking system is not in crisis:

On 9/19/08

CNN reported the 12th bank failure of the year. According to the data presented by CNN, 1/10th of 1% of the banks insured by FDIC have failed this year (12 failures, 8,451 insured).

From

this FDIC page, I produced a detailed report including the total assets associated with each failure for each year.

From that report:

1) 2008 - 11 Bank failures totaling $40,443,315,000 in assets.

The 12th failure, reported on 9/19/08, is not yet in their database.

2) 1989 - 534 Bank failures totaling $164,180,003,000 in assets.

Note: At the FDIC link, the assets are reported in thousands of dollars.

Update: On 9/26/08 it

was reported that Washington Mutual, with assets of $307 Billion,

“failed”. The Federal Deposit Insurance Corp. seized Washington Mutual. But, WaMu’s assets were sold to JP Morgan Chase in a transaction which did not cost the FDIC anything.

What really counts in these failures is not the “Total Assets” but the “Estimated Loss” paid out by the FDIC. That metric is not yet available for 2008. But, we know two things for sure:

* The “Estimated Loss” to the FDIC cannot exceed the Total Assets.

* Washington Mutual will add a grand total of $0.00 to the “Estimated Loss” metric.6) The

condition of the overall economy also does not support this draconian $700 billion bailout.

The Conclusion -Sorry Secretary Paulson - NO SALE! You are welcome to try again. But, next time, SHOW ME SOME DATA!

Also See -For LOTS more information,

click here & see my original reaction to this proposed bailout.

Please Register Your Opinion -Please

contact your representatives and tell them you oppose this bailout!

From the above link, I suggest you copy and paste the following into the form:

I oppose the $700 billion dollar mortgage bailout because the data do not support the thesis:

http://sbvor.blogspot.com/2008/09/700-billion-dollar-bailout-for-what.html

Act NOW! Congress will probably vote in just a few days (at MOST)!