“Standard & Poor's… said that it revised its outlook on the long-term rating of the U.S. sovereign [debt] to negative from stable…

In 2003-2008, the U.S.'s general (total) government deficit fluctuated between 2% and 5% of GDP. Already noticeably larger than that of most 'AAA' rated sovereigns, it ballooned to more than 11% in 2009 and has yet to recover…

We believe there is a significant risk that Congressional negotiations could result in no agreement on a medium-term fiscal strategy until after the fall 2012 Congressional and Presidential elections…

Even in our optimistic scenario, we believe the U.S.'s fiscal profile would be less robust than those of other 'AAA' rated sovereigns by 2013.”

Click here to enlarge the image.

Click here & examine the Dim spending spree.

This S&P announcement has already impacted financial markets. If, as they now project, S&P lowers the credit rating for our national debt, we will -- at best -- pay a higher interest rate on that debt (driving us even more quickly into bankruptcy). At worst, nobody will buy that debt and we’ll be cut off like a junkie without a dealer (and suffer even worse withdrawals).

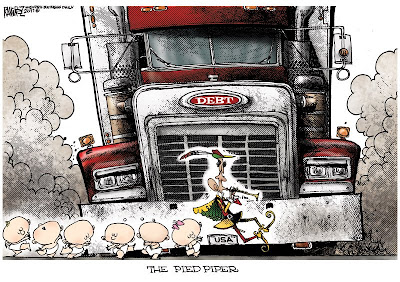

We can pay the Piper now or pay him a whole lot more later. Either way, the Piper WILL get paid!

Boot the Dims out of the Senate in 2012!

No comments:

Post a Comment