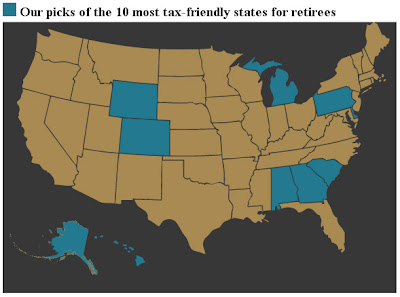

with the most favorable tax codes for retirees:

When deciding which state has the most favorable tax codes, each individual has to look at their own personal circumstances. Some states are friendlier to those who work for a living. Other states are friendlier to those who are retired. But, those are generalities. Income level, consumption habits and housing value are just the top three other variables which one must take into account. Local tax rates are another very significant consideration.

Click here to examine state income tax levels.

Click here to examine property tax rates by state.

Click here to examine state sales tax rates (excluding often exorbitant local sales tax rates).

Click here to examine average combined state & local sales tax rates. Note that local taxes can vary a great deal.

No comments:

Post a Comment